36,000 Bonus Points: Virgin Rewards Plus Credit Card Offer

I’ve never got around to posting such amazing offers before, but that changes now.

Virgin Money has launched a tempting new Virgin Rewards Plus Credit Card, offering a massive 36,000 Virgin Points welcome bonus – plus all the usual perks that savvy flyers love. In the recent past the standard offer was a 15,000 points welcome, so this is quite a leap up!

In my opinion this Virgin Money/Mastercard offer is the most attractive non-Amex card in the UK at the moment. Here’s a rundown to show why this card could be your passport to premium travel and how it stacks up key benefits and cost.

Disclaimer

This article is for information only and does not constitute financial advice.

Please assess the Virgin Atlantic Reward+ Credit Card according to your own personal circumstances

and, if in doubt, seek the advice of a qualified financial advisor.

Why Virgin Rewards Plus Credit Card Is Attractive

-

Huge Welcome Bonus

-

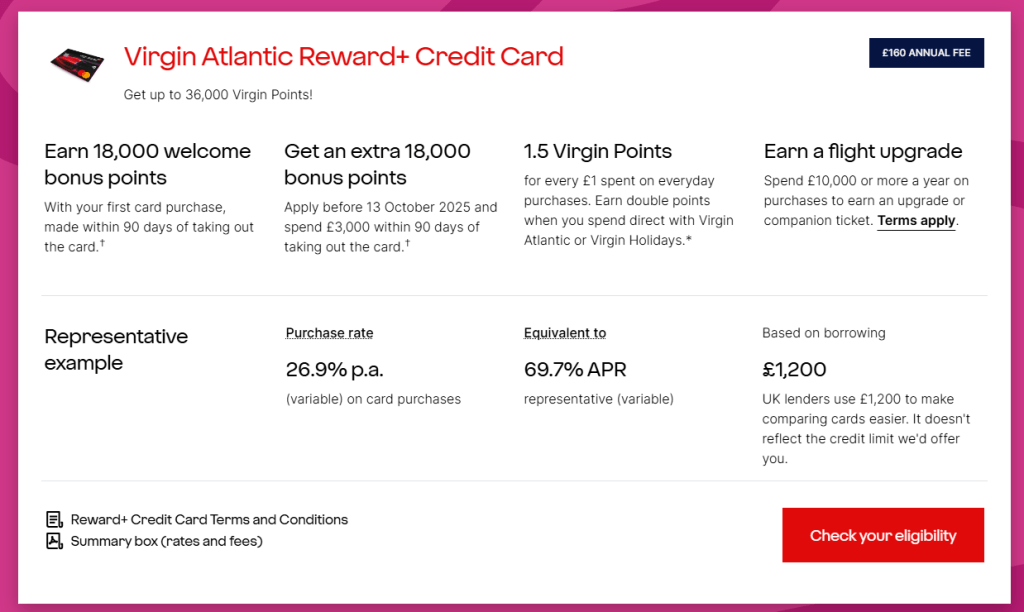

18,000 bonus points simply for making your first purchase within 90 days of account opening.

-

An extra 18,000 points available if you apply by October 13, 2025 and spend £3,000 within those same 90 days ( note: the £160 annual fee doesn’t count toward the spend)

-

-

Solid Everyday Earning

-

Earn 1.5 points per £1 on everyday spending, and double points (3 points per £1) when spending directly with Virgin Atlantic or Virgin Holidays

- Given most AMEX cards earn at most 1 point per £1 spent as standard – this is a 50% increase in everyday reward earnings!

-

-

Meaningful Annual Reward

-

Spend £10,000 in a year, and you’ll receive a Flying Club reward voucher. For comparison this is much lower than the 15K spend required for the nearest BA Amex card.

This voucher can be used for towards an upgrade or companion seat but the value you can get is capped depending on your Virgin status:

-

Up to 75,000 points value for Red tier

-

150,000 points value if you’re Silver or Gold when redeeming

-

-

-

No Foreign Fees (in the right places)

-

Enjoy no fees on card purchases in Euros, Swedish Kronor, or Romanian Lei while traveling within the EEA (elsewhere, a 2.99% fee applies)

- Yet again this is a huge plus over Amex or other reward cards that charge for all foreign spend.

-

-

Access 200+ Virgin Red Rewards

-

Use your Virgin Points with Virgin Red for hotels, experiences, cinema treats, and more beyond flights or upgrades

-

Annual Fee & Interest Rates

-

Annual Fee: £160—less painful if the benefits justify it.

-

Interest Rate: Purchase rate is 26.9% p.a. (variable), with a representative APR of 69.7%

Only get this card if you plan to pay your balance in full -otherwise, interest could negate the value of the points.

Key Terms & Conditions (Quick-Read Format)

Eligibility

According to it’s tool these are the 3 main criteria’s

- Be a UK resident aged 18+ (the same goes for any additional cardholders you want to add)

- Have a UK bank or building society account

- Have a personal income of at least £7,000 per year before tax and pass our affordability checks

| Term | Summary |

|---|---|

| Welcome Bonus | 18,000 points for first purchase within 90 days; extra 18,000 points for spending £3,000 in that period if applied by 13 October 2025 (the £160 fee doesn’t count toward the spend). Must link Flying Club by 11 January 2026 to qualify.

No specific exclusions if you’ve had the card before. |

| Points Earnings | 1.5 pts/£ on general spend; 3 pts/£ on Virgin Atlantic/Virgin Holidays. No points for cash advances, balance transfers, interest, or fees. |

| Monthly Points Cap | You only earn points up to your credit limit per month (e.g., £5,000 monthly limit → points on first £5,000). Cap resets on each statement date; bonus points are excluded from the cap. Virgin Money |

| £10,000 Annual Reward | Spend £10,000 in 12 months → Flying Club voucher (value depends on tier at redemption: 75,000 pts Red; 150,000 pts Silver/Gold). One voucher per year; valid for 24 months outbound. |

| Foreign Transaction Fee | None for spending in EUR, SEK, RON within the EEA; 2.99% elsewhere. Virgin Money |

| Account Conditions | Must be UK resident 18+; card issued by Clydesdale Bank (Virgin Money), subject to status. If you miss a payment or go over limit, promotional rates are removed. No balance transfers from Virgin Money/Clydesdale/Yorkshire Bank/B credit cards. |

So, Is It Worth It?

Yes, especially if:

-

You can hit £3,000 spend in 3 months for the full 36,000-point welcome bonus.

-

You’re disciplined—pay your card off in full to avoid interest.

-

You regularly book with Virgin Atlantic or Virgin Holidays (3 pts/£ is powerful).

-

You’ll genuinely use or top up toward the £10,000 annual reward voucher, and can leverage upgrades or companion trips value-effectively.

-

You travel (particularly in the EEA and beyond), maximizing the no-fee Euros spend perk.

I’ve spoken in detail about the frustrations of Virgin moving to a dynamic pricing model for award seats, that withstanding, there are some great uses, especially if you’ve earned a bunch of points for free..

Trips You Can Book Just with these Bonus Points

Theoretically speaking 36,000 points could get you:

- 3 return Economy trips to New York/Boston etc at the Economy saver rate + the applicable taxes.

- A return to most of the USA/India/Middle East in the fantastic Virgin Premium Economy !

- If you are set on Upper Class, this can also get you a one-way to New York or India ( but you need to be super flexible, travel off-peak and snap them up as soon as they area released !

And this is all without the additional points you would earn for spending, at the minimum 15,000 points to trigger the voucher. Reward Voucher would unlock a return trip in Upper Class for you an a companion!

Free Virgin Reward Credit Card

For those that do not want to pay an annual fee and may not trigger the bonus on the Plus card the free card also comes with a 3000 Welcome Point + 3000 Bonus Points on spend of £1 within 3 month.

Naturally, the earning rate is much less lucrative at 0.75 point per £ spend. Furthermore, you’d need to spend £20,000 to trigger the voucher

Final Thoughts

The Virgin Atlantic Reward+ Credit Card is a high-value tool for engaged flyers—offering a standout sign-up haul, solid earn rates, travel-friendly benefits (no Euros fees), and that powerful annual reward voucher.

You can apply here directly and check your eligibility before you make the application.

Just pair it with savvy spending and the the Virgin redemption strategies & Sweet spots and you could be enjoying a toast in the air before you know it !

⚠️ Important Note

This post is for informational purposes only and should not be taken as financial advice. Please assess the product according to your own personal circumstances and, if in doubt, seek the advice of a qualified financial advisor.

Faze, founder of Wander Up Front and Elevate Your Stay, is a London-based travel specialist with a deep passion for aviation. With over 2 million miles flown, he has spent the last 7 years focusing on First and Business class experiences.

Faze provides straightforward, no-frills insights into premium airline products and services, sharing what matters to help travellers make informed choices.

Follow him on his adventures and behind the scene stories on Instagram !